Rolling debt payoff calculator

This calculator utilizes the debt avalanche method considered the most cost-efficient payoff strategy from a financial perspective. Ad Edward Jones Offers Financial Guidance Tailored to Your Goals.

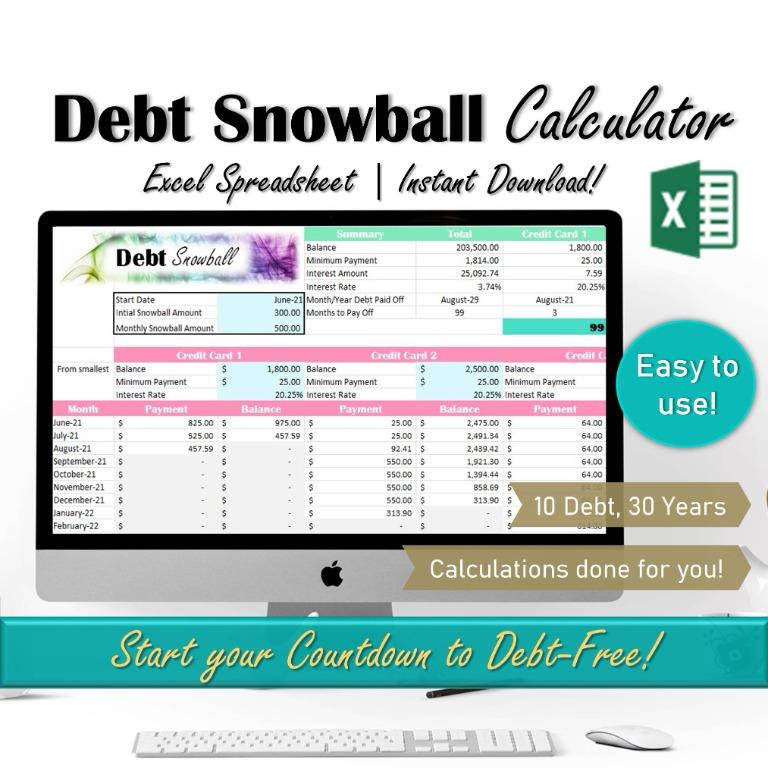

Using Debt Snowball Worksheets To Wipe Out Debt

Finding when you will be debt free in case you decide to make extra payment regularly in smaller.

. For this step youll need to input the basic information you collected about your existing debt into the debt calculator including the current balance due interest rate and minimum monthly payment. This calculator will demonstrate just how much time and money you could save by paying off your debts with the rollover method. Perhaps you want to be debt free before you go back to college move to a new city or before the new baby arrives.

Determine which debt to start repaying first. Include all your debtsminus mortgage s if you have anywith the account types balances interest rates and minimum amount due each month. Pay as much as possible on your smallest debt.

Enter the account name and balance for your various debts such as credit card debt student loans or medical bills in the debt calculator. If you are curious how long it will take you to pay off debts use this debt payoff calculator to get an accurate idea of the total interest charges number of monthly payments and total number. E2 D1 D2.

How to use this debt snowball payoff calculator. The Annual Percentage Rate APR of the debt. NPVA ln 1 PV i L-1 ln 1i Wherein PV is the present value of Outstanding Balance.

B2 A1 A2. You can even create a payment schedule and payoff summary. Next input the monthly dollar amount you can add to.

Accelerated Debt Payoff Calculator. List your debts from smallest to largest regardless of interest rate. Additionally it gives users the most cost-efficient payoff sequence with the option of adding extra payments.

If you have more than one loan you can enter the total outstanding balances of all of them. The calculator below estimates the amount of time required to pay back one or more debts. This calculator will show you how long it will take to pay off a loan and how much interest will accrue over the length of the loan.

The outstanding balance of the debt. Find Out How Edward Jones Can Assist in Reaching Your Goals. I is the rate of interest.

C1 A1 CMP. Once you pay off a smaller debt the payment amount attached to the smaller debt is applied to the next larger debt. L is the new Payment.

This Debt Payoff Calculator reveals how much you need to pay each month in order to be out of debt by a certain date. Apart from this tool you may also be interested in our debt reduction calculator that can help you perform more advanced calculations such as. The reality is debt can truly weigh you down but take heart with a smart plan you can escape.

Our debt avalanche calculator will show you which debt to start repaying first based on your balance with the highest. L is the existing Payment. With every debt you pay off you gain speed until youre an unstoppable debt-crushing force.

NPVA is the number of periodical payments. Plug in your debt details. D1 C1 CDB.

As you pay off each small debt the amount freed-up is utilized to pay down the next larger debt and so on. Below is more information about the debt snowball plan to help you break. Rolling debt payoff calculator Sabtu 03 September 2022 Edit.

Enter your loan details. Have your annual interest rates minimum payment amounts and percent ready. Build Your Future With a Firm that has 85 Years of Investment Experience.

Heres how the debt snowball works. If you are curious how long it will take you to pay off debts use this debt payoff calculator to get an accurate idea of the total interest charges number of monthly payments and total number of years your debt payoff period will consist of. In order from the smallest to the highest balance enter the name current balance interest rate and minimum payment amount for your debts up to a maximum of 10 debts.

Input some information about your current credit card and loan debts including how much you owe interest rate and minimum monthly payment amount. If you have multiple debts use the weighted. Explore the possibilities of student loan forgiveness program with an Equitable 403b.

Our Debt Snowball Calculator makes the process easy. The author of the spreadsheet and the Squawkfox blog Kerry Taylor paid off 17000 in student loans over six months using this downloadable Debt Reduction Spreadsheet. Ad Our easy-to-use calculator can help see if you might qualify for debt relief.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. How to use our debt payoff calculator. Our calculator can help you estimate when youll pay off your credit card debt or other debt such as auto loans student loans or personal loans and how much youll need to pay each month based on how much you owe and your interest rate.

C2 A2 CMP PDA. D2 C2 CDB. The debt payoff calculator has three required fields and one optional field.

Enter the balance of the loan as the Loan Balance and. The rollover method work like this. Simply fill out the form with all your debts enter a monthly dollar amount you can add to your payoff plan and click the Calculate Debt Snowball button.

Compare debt repayment plans. Make minimum payments on all your debts except the smallest. Use our calculator to compare the debt snowball and avalanche methods.

Start by entering your creditors current balance interest rates and monthly payments to see your current total debt average interest rate and average monthly interest. It is a handy calculator as it will calculate the tenure when all the debts are paid off. Most everyone would prefer to live debt free and by adding to your monthly payment toward a debt you can become debt-free quickly and save money on interest.

Youll also be able to see how much principal versus interest youll pay over the lifetime. N is the frequency of payments. How to use our loan payoff calculator.

The calculator below estimates the amount of time required to pay back one or more debts.

9 Debt Snowball Calculators To Supercharge Your Debt Payoff

Debt Reduction Calculator Tutorial Use A Debt Snowball To Pay Off Debt Youtube

9 Debt Snowball Calculators To Supercharge Your Debt Payoff

Free Printable Debt Snowball Worksheet Pay Down Your Debt Debt Snowball Worksheet Debt Snowball Free Budget Printables

Credit Card Payoff Calculator Excel And Google Sheets Free Download

How To Pay Off Debt And Create Your Own Debt Payoff Calculator

9 Debt Snowball Calculators To Supercharge Your Debt Payoff

Debt Snowball Payoff Calculator See Your Payoff Date Nerdwallet

Debt Payoff Calculator Estimate Your Debt Free Date Credello

Debt Payoff Calculator Spreadsheet Debt Snowball Excel Etsy Credit Card Debt Payoff Saving Money Budget Money Saving Plan

Debt Snowball Spreadsheet Moneyspot Org

Debt Snowball Excel Spreadsheet Debt Payoff Calculator Dave Ramsey Snowball Debt Spreadsheet Personal Finance Debt Payment Tracker Hobbies Toys Stationery Craft Other Stationery Craft On Carousell

Debt Snowball Spreadsheet Moneyspot Org

Free Debt Snowball Calculator How Soon Could You Be Debt Free

Free Debt Snowball Excel Worksheet With Chart Debt Snowball Debt Snowball Worksheet Credit Card Debt Payoff

Debt Snowball Spreadsheet Moneyspot Org

Debt Snowball Tracker Printable Debt Payment Worksheet Etsy Debt Snowball Debt Snowball Worksheet Credit Card Debt Payoff